Financial Goal based Planning for NRI in India

- Are you NRI and planning to Retire in India?

- Are you an NRI who is making most of your investments during your short visits to India?

- Are you forced to take quick investment decisions because of the tight-packed agenda during those short visits?

How prepared are you for your Retirement?

- As an NRI, are you completely satisfied in the way you have been planning for your retirement?

- In the case of NRIs, there are some crucial pointers that determine the success or failure of a retirement plan . Key to that is whether you are heading back to India and when. As an NRI, it becomes more important to have a dipstick of various possible safer investments for when you retire and/or return back home.

- Our society is changing. Nuclear families are the norm. Inflation is high and hence money needed to fund the retirement is increasing. Additionally due to longevity of life, the requirement for retirement fund will further increase. This is where the right retirement planning helps individuals spend their time in old age with dignity.

- A high-quality financial plan that integrates the financial goals that you have for you and your family, as well as your global assets, investments, loans, income and expenses, will enable you to better align your current and future savings to the needs of your family’s dreams.

- Most of the Indians living in foreign countries plan to come back to India at some point in time in the future. Hence it is important that they plan for their retirement in India.

- Even though many NRIs plan to come back in the later stages of life, their children will not come back. They do not have much idea about the options available in the Indian market which prevents them from planning well for their retirement

- NRIs who are not sure whether they will return back to India or will continue to live overseas. If you are not sure about your final destination for retirement, it is best to create two versions of your financial plan, and then ensure that your investment strategy retains flexibility to deal with either of these two scenarios.

- It is always better to have diversification in investment across asset category, financial institution and country to have more gain and keep portfolio always in GREEN.

Attractive Investment Options for NRIs

When it comes to NRI investments in India, the avenues are numerous. Our team introduces you to the best investment options in India: Bank Fixed Deposits, Mutual Funds, Direct Equity, Real Estate, Bonds and Government Securities, and Certificate of Deposits (CDs) among others.

How can you manage your wealth in India when you are a NRI?

The answer is simple – with our help. We provide NRI consultancy services for managing your wealth. As such, your investments are made easy even when you are abroad!

Easy Investment Experience : Enjoy a seamless experience for managing your investments in India, from anywhere in the world, at any time.

Diversified Investment Options : Make the most of our rich range of investment instruments specially recommended to our NRI clients.

Proficient Research Team : Get the latest market trends, updates, and information from our highly specialized research team from NJ Wealth through digital platform.

Here are Investment Options for NRIs

Real estate: As an NRI, you can invest in the booming Indian real estate market by buying commercial and/or residential properties. Huge investment and less liquidity.

Equity market: An NRI can invest in shares ETFs (exchange-traded funds) both on repatriation and non-repatriation basis. For this they need to open a demat trading account. High return with high risk.

Bonds and NCDs (non-convertible debentures): NRIs can invest in bonds and NCDs issued by the government for better liquidity and to get better returns. Low to average returns and cannot beat inflation.

Bank Fixed Deposits: A bank fixed deposit is where you invest for a fixed lock-in period and get returns. Give low returns and cannot beat inflation. Low returns and cannot beat inflation.

Mutual funds: NRIs can also invest in mutual funds in different equity and debt securities, which are available for investments for NRIs. Managed risk, higher returns as compared to other investment. Goal based investment for Retirement Planning, Child Education and Marriage expenses. Systematic Investment Plan (SIP), SWP and STP are various ways for each investment goal and returns.

National Pension Scheme (NPS): NPS is tax-effective and follows EET (Exempt-Exempt-Tax) structure for taxation. NPS offers good returns and is a good investment undertaking. Low to average returns and cannot beat inflation.

Invest in a Promising Economy

India is emerging as a fast growing investment destination for Non-Resident Indian (NRI), owing to its growing economy and a strong Rupee. Furthermore, profitable organizations in the market, combined with a transparent stock exchange and mutual fund industry, ensure that investors get optimum returns from both equity and debt markets for their NRI investments in India.

So what are you waiting for? Indian investments can help you create substantial wealth. Find out the best companies to invest in India and invest your hard-earned money. If finding such companies is a tough job for you, leave it to us. With our NRI consulting services you would be educated about the best companies to invest in India. You can then plan your NRI investments in India with our expert advice and maximise wealth.

How can NRI invest in Mutual Funds?

All NRI’s (other than from USA/Canada), can invest in most of the Mutual fund schemes, available in the market. NRI from USA/Canada are also allowed, but in selective Mutual Fund schemes, due to different compliance requirement of USA/ Canada regulators. To invest in Mutual Funds, investor must first complete the KYC (know your client) documentation, as per SEBI guideline, which need below documents:

1) PAN Card Photocopy: Self Signed : 2 copies

2) Passport : Self Signed: 2 copies. (Relevant pages with name, date of birth, photo and address. Usually available in first and last page of passport)

3) AADHAR Card Photocopy two sides: Self Signed : 2 copies

4) Bank Cheque (NRE/NRO Account) for each Mutual Fund

5) Passport size photograph : 2

6) Overseas Address Proof Photocopy

7) India Address Proof Photocopy (ignore if AADHAR Card is present)

8) Bank passbook/statement : If investor name is not printed on Bank Cheque; then bank passbook photocopy is also required

Note : These document can be changed based on KYC status, unavailbility of any document.

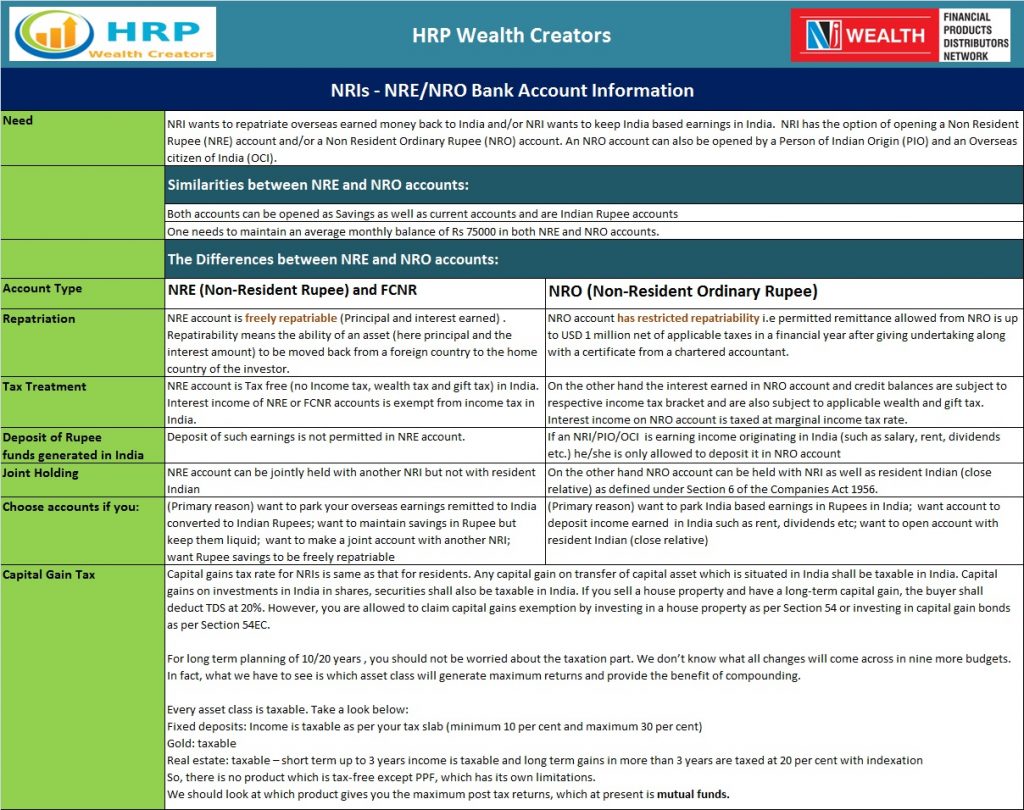

NRIs - NRE/NRO Bank Account Information

You get to choose from a range of best investment plans. Our NRI consulting services understand your risk profile and investment preference and also extend guidance in choosing the best investment options in India. There is no limit on the avenues you can choose as long as you have access to these investment plans in India and our NRI consultancy provides you this access which allows you to earn maximum returns.

Please visit Account Opening Process to get more details OR reach out to us.